10 Important Dealership Regulations: How to Protect Yourself and Your Customers

Running a dealership today means more than managing inventory and closing deals; it’s about staying compliant in a highly regulated industry. With increasing federal and state oversight, the consequences of non-compliance can be severe, ranging from hefty fines to reputational damage and even criminal penalties.

At the same time, today’s consumers are more privacy-conscious, and the regulatory landscape continues to evolve. Legal compliance has become essential, not just in finance and sales, but across every department, including service and operations. Understanding and adhering to core dealership regulations is crucial for building trust, avoiding costly mistakes, and future-proofing your business.

This blog explores 10 essential dealership rules and regulations. Mastering these will help you operate responsibly, safeguard your customers, and maintain a strong, compliant reputation in the automotive industry.

Data Privacy & Consumer Protection Laws

1. Gramm-Leach-Bliley Act (GLBA)

This federal regulation concerns consumer data privacy and security. As a dealership, you handle sensitive nonpublic personal information (NPI)—names, addresses, social security numbers, and financial records. The GLBA ensures that this data is handled responsibly.

- Privacy Rule: Regulates how you share consumer information, especially for credit or leasing purposes.

- Safeguards Rule: Requires a documented information security plan that outlines how you protect customer data.

For those wondering what the safeguards rule for auto dealers entails, this provision requires you to implement administrative, technical, and physical measures to secure consumer information, making it a core part of your dealership’s compliance strategy.

Penalties: Institutions can face fines of up to $100,000 per violation, and individuals face fines of $10,000 or up to 5 years in prison.

2. Disposal Rule

When you’re done using Consumer Reports, what happens to them? This rule mandates that dealers dispose of them securely by shredding documents or permanently erasing digital files.

Best Practice: Make this part of your Safeguards Rule strategy. Secure disposal is not optional—avoiding identity theft risks is essential.

3. California Consumer Privacy Act (CCPA)

Even if you’re not based in California, this act is a harbinger of future things. More states are following suit with similar data privacy laws.

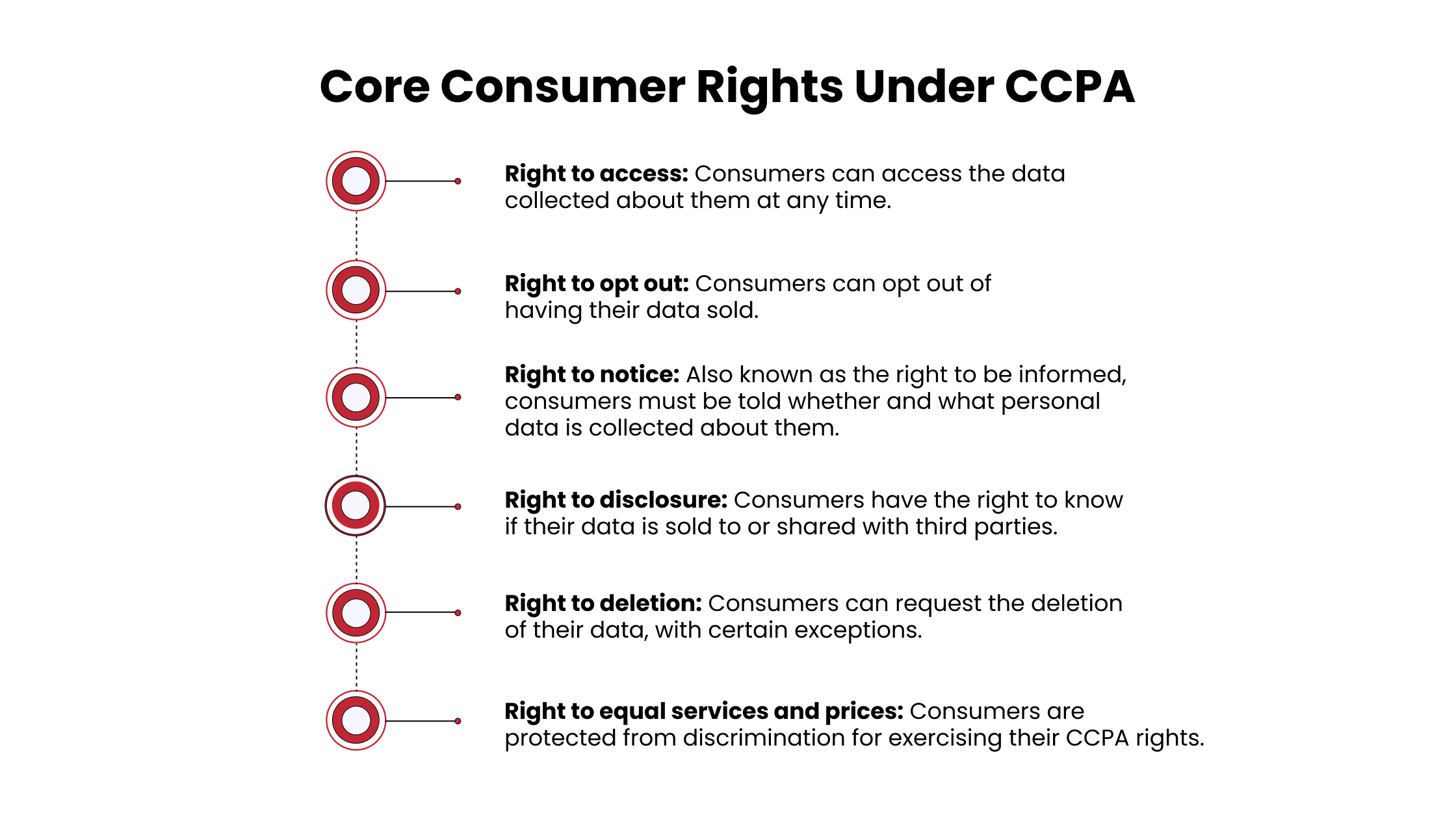

Core Consumer Rights Under CCPA

- Right to access: Consumers can access the data collected about them at any time.

- Right to opt out: Consumers can opt out of having their data sold.

- Right to notice: Also known as the right to be informed, consumers must be told whether and what personal data is collected about them.

- Right to disclosure: Consumers have the right to know if their data is sold to or shared with third parties.

- Right to deletion: Consumers can request the deletion of their data, with certain exceptions.

- Right to equal services and prices: Consumers are protected from discrimination for exercising their CCPA rights.

Proactive Tip: Start aligning your privacy policies now, even if you’re outside of California. It’s only a matter of time before broader car dealership regulations and new FTC regulations for car dealerships take effect nationwide.

Consumer Rights at the Point of Sale

4. Magnuson-Moss Warranty Act

This law ensures that any written warranty is clear, enforceable, and easy to understand.

Dealership Responsibilities

- Label warranties as either “full” or “limited.”

- Provide clear documentation of warranty coverage.

- Display warranty info prominently at your dealership and on your website.

Applies to new and used vehicles, aftermarket parts, and services like tire replacements. Clear communication prevents misinterpretation and builds consumer trust.

5. FTC Used Car Rule

This rule implies that if you’re selling used vehicles, you must provide a Buyer’s Guide before the sale.

(Click here to get the template of Buyer’s Guide: Download)

Guide Requirements

- Warranty information

- Mechanic inspection advisory

- List of major mechanical/electrical systems

Penalty for Non-Compliance: Up to $40,000 per vehicle violation.

Ensure every used car has a visible Buyer’s Guide on the window—no exceptions. This is one of the most overlooked dealership rules and regulations, yet one of the most enforced by the FTC.

Finance, Lending & Anti-Discrimination

6. Truth in Lending Act (TILA) / Regulation Z

This act mandates transparency in credit terms and consumer lending.

You Must Disclose

- APR and finance charges

- Total of payments and sale price

- Prepayment penalties

- Identity of the creditor

- Payment schedule

Penalties: Up to $5,000 and/or 1-year imprisonment.

Provide these disclosures in writing to help consumers make informed decisions and protect your dealership legally.

7. Equal Credit Opportunity Act (ECOA)

According to this act, discrimination in lending is illegal, and dealerships are considered creditors.

You cannot Discriminate Based On

- Race, color, sex, age

- Religion or national origin

- Marital status or public assistance income

Additional Duties

- Notify applicants of decisions

- Report joint credit accurately

- Retain records for compliance

Tip: Ongoing training for financing and sales teams is critical to ensure equal opportunity lending practices and compliance with car dealership regulations.

8. Red Flags Rule

Fraud is rising, and this rule requires a written Identity Theft Prevention Program (ITPP).

Look for Red Flags

- Suspicious identification documents

- Inconsistent credit information

- Unusual purchasing patterns

Your Action Plan

- Detect red flags.

- Prevent and mitigate identity theft.

- Train your staff regularly.

Staying ahead of identity theft is not just good practice—it’s compliance with critical dealership regulations.

Cash Payments, Trade Restrictions & Employee Safety

9. Form 8300 Reporting

According to this federal law, if your large cash transactions (over $10,000) must be reported to the IRS and FinCEN using Form 8300.

- Applies to single payments or multiple related payments.

- Must be filed within 15 days of the transaction.

- Helps prevent money laundering and tax evasion.

Don’t let large cash sales go undocumented—doing so invites serious federal scrutiny and violates key car dealership regulations.

10. OFAC Compliance

The Office of Foreign Assets Control (OFAC) maintains a list of individuals and entities involved in terrorism, trafficking, and financial crimes.

Dealer Obligation: According to this, the dealerships must screen all buyers against the Specially Designated Nationals (SDN) list before closing a sale. Failure to do so can result in penalties and severe reputational harm.

Bonus Regulation: OSHA 29 CFR 1910.157

Don’t forget employee safety! This OSHA standard mandates that all businesses have a written Emergency Action Plan.

Dealership Requirements

- Emergency procedures

- Evacuation protocols

- Communication guidelines

Even the most polished auto showrooms need a plan for unexpected risks, fires, compliance audits, or cyber threats. Following essential dealership rules and regulations isn’t just about avoiding penalties; it’s a sign your dealership runs with professionalism, transparency, and trust.

By staying ahead of auto dealership regulations like the Safeguards Rule or new FTC mandates for car dealerships, you reinforce that your business puts compliance and customer care first, precisely what today’s savvy buyers expect.

If you want your team to meet regulations and outperform the competition, explore in-store compliance and sales training with Automotive Training Network. With 40+ years of industry expertise, ATN transforms your dealership’s people and processes into high-performing, regulation-ready pros.

Compliance Starts at the Service Drive: Train with ATN

Compliance doesn’t stop at the sales desk in today's regulatory environment. Your service advisors are on the frontlines of customer communication, data handling, and daily operations, making proper training essential for regulatory alignment and risk reduction.

That’s where the ATN comes in.

With over four decades of dealership expertise, ATN helps fixed ops teams meet and exceed compliance expectations—from customer interaction and upsell ethics to technical knowledge and problem-solving under regulatory scrutiny.

How We Support Your Compliance Strategy:

- Virtual Interactive Training: Hands-on modules, tailored to current regulations and real-world service challenges, led by industry experts.

- Bootcamps: Focused, high-impact training designed to build core service knowledge and reinforce dealership rules and policies.

- Ongoing Coaching: Continuous improvement and compliance-readiness support to help your team adapt as regulations evolve.

Ready to align your service department with the same regulatory excellence as your sales and finance teams?

👉 Talk to ATN today and discover how custom training can elevate your advisors while safeguarding your dealership’s reputation!