How Can Dealerships Overcome Inventory Shortages in 2026?

If you thought the inventory crunch was behind us, you might be wrong. Entering 2026, dealerships across the U.S. will still be feeling the ripple effects of constrained production and unpredictable supply chains. New-vehicle inventory dropped to just 2.89 million units in September 2025—a 4% decline year over year. That shortfall translates directly into fewer cars on the lot, tighter margins, and more challenging conversations with eager buyers who can’t find what they want.

For many dealerships, the challenge is managing the stock available while maintaining stable profits and loyal customers. The stores that thrive in 2026 will be those that plan, adapt fast, and treat inventory management as a leadership discipline, not a logistical headache.

In this blog, we’ll understand five practical ways your dealership can overcome inventory shortages in 2026.

Root Causes of Inventory Shortage Every Dealership Should Monitor

Even as production levels stabilize, dealerships continue to deal with a complex inventory. Understanding the underlying causes of these ongoing shortages helps leadership make better decisions about ordering, pricing, and customer communication. The more clarity you have on what’s really driving the issue, the more effectively you can plan around it.

Here are the main factors impacting availability:

- Semiconductor and Component Delays: Automakers continue to face shortages of chips and electronic components, creating production backlogs that trickle down to dealership allocations.

- Global Supply Chain Pressure: Shipping delays, limited transport capacity, and raw material constraints still slow vehicle delivery times and increase unpredictability.

- Model and Trim Demand Shifts: Changing consumer preferences toward EVs, hybrids, and specific high-demand trims lead to uneven supply, making certain configurations difficult to secure.

- Used Vehicle and Trade-In Gaps: With fewer lease returns and trades entering the market, sourcing quality used inventory remains a persistent challenge.

- Floor Plan and Inventory Costs: Higher financing rates make it riskier to overstock, forcing dealerships to balance tighter supply with profitability and demand accuracy.

These pressures keep changing. Dealerships that monitor them closely and adjust strategies early will outperform those waiting for supply to “get back to normal.” Staying informed, agile, and data-driven will remain the most effective way to stay ahead of ongoing inventory volatility.

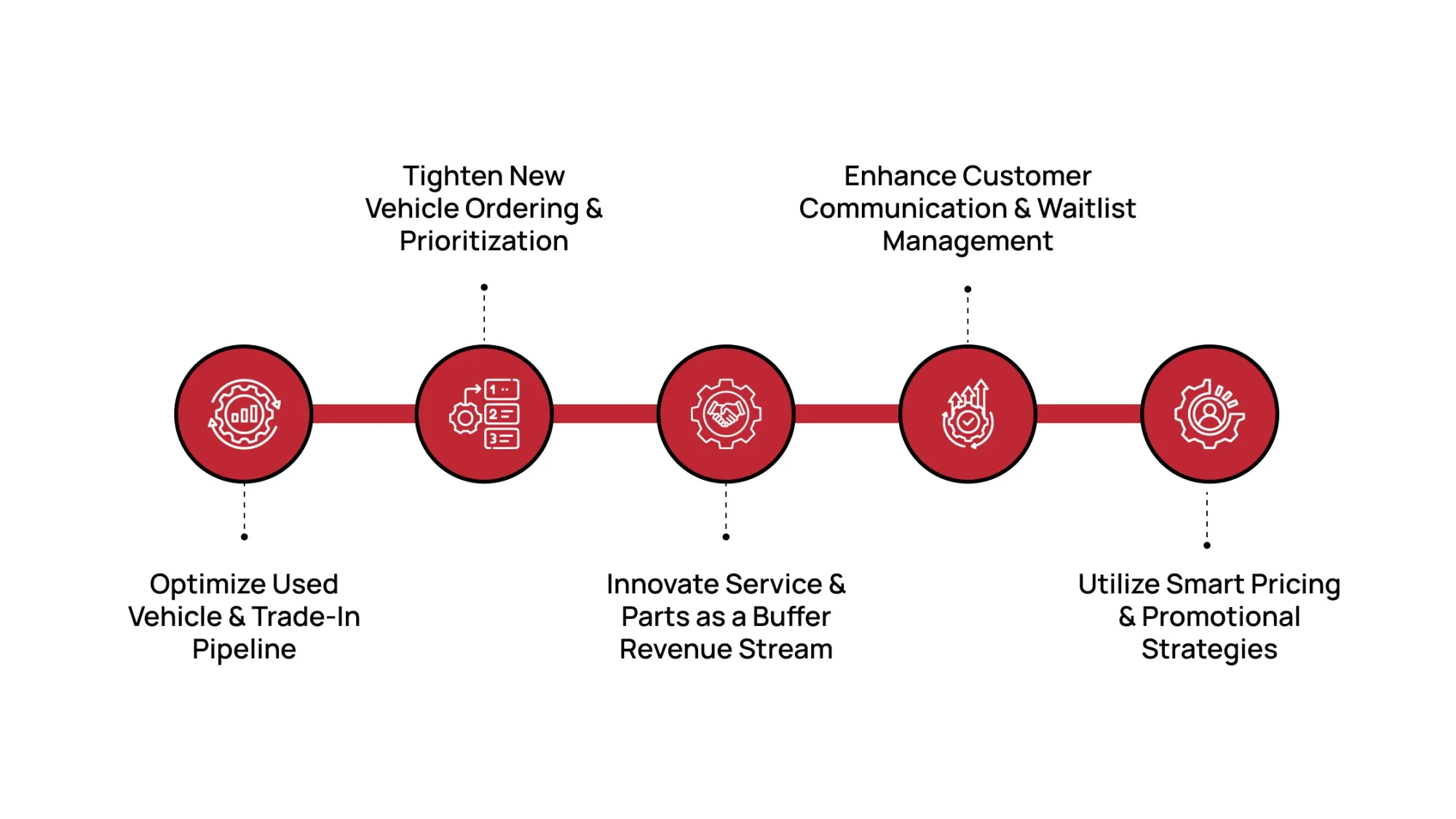

Five Tactical Ways to Overcome Inventory Shortages

Knowing why inventory shortages persist is only half the equation. The real opportunity lies in how your dealership responds. The most successful operators adapt their sourcing, selling, and retention strategies to perform under any market condition rather than waiting for production to normalize.

1. Optimize Used Vehicle & Trade-In Pipeline

When new vehicle flow slows, the used department becomes the dealership’s primary driver of sales and profitability. Every trade-in, lease return, and service customer represents a sourcing opportunity, but only if the process is intentional and strategic. Successful dealerships treat used inventory management as a structured, ongoing initiative, rather than a reactive response to shortages.

Building a reliable used pipeline requires collaboration across departments and consistent communication with past customers. Here’s how your team can strengthen sourcing and keep inventory balanced year-round:

Best Practices to Strengthen the Used Pipeline:

- Service Department Alerts: Review daily service appointments to identify vehicles that are five years or older and may qualify as trade-in candidates.

- Customer Retention Follow-Up: Utilize CRM campaigns to re-engage customers who made a purchase more than two years ago with updated trade-in value offers.

- Early Trade Discussions: Train sales staff to introduce trade conversations early in the process, not only during negotiations.

- Accurate Appraisals: Use consistent valuation methods to ensure trade offers remain competitive without overextending profit margins.

- External Partnerships: Build relationships with fleet, rental, and wholesale partners to supplement inventory gaps when sourcing slows.

This five-minute activity reinforces that strong trade-in results stem from a well-defined process and effective follow-up. When sourcing becomes proactive, dealerships maintain profit, customer loyalty, and stability even when new inventory remains limited.

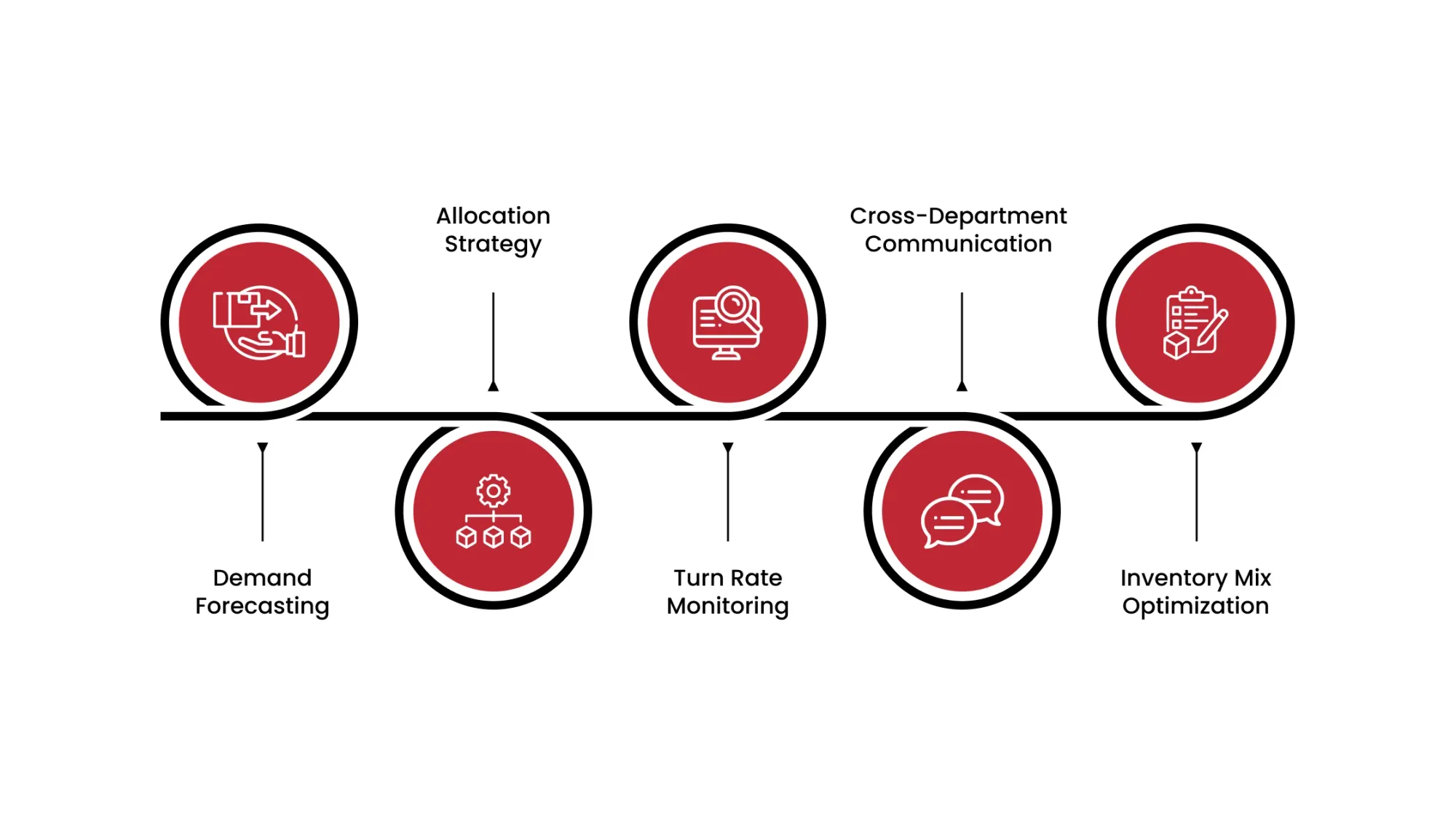

2. Tighten New Vehicle Ordering & Prioritization

When inventory is tight, every allocation matters. Ordering the right mix of models, trims, and configurations can be the difference between turning stock quickly and holding units that sit for months. Tightening your ordering process means using data to ensure that what’s arriving aligns with what’s selling.

Dealerships that prioritize smart ordering decisions rely on CRM, DMS, and sales reporting to track customer demand patterns, monitor vehicle performance, and predict high-turn inventory. This approach protects cash flow, improves floor plan efficiency, and strengthens OEM relationships.

Best Practices for Smarter Vehicle Ordering:

- Demand Forecasting: Use sales history, market trends, and CRM data to identify top-selling trims, colors, and packages. Order based on actual buyer behavior rather than assumptions.

- Allocation Strategy: Coordinate with your OEM representative to prioritize profitable models and fast-moving items, thereby reducing the risk of slow-turning inventory.

- Turn Rate Monitoring: Review days-to-turn data monthly to identify which vehicles need pricing or promotional adjustments before they age out.

- Cross-Department Communication: Include both sales and F&I leaders in ordering discussions to balance front-end profit potential with backend product opportunities.

- Inventory Mix Optimization: Maintain a healthy balance between new, used, and certified pre-owned units to ensure customer options even when OEM supply fluctuates.

3. Innovate Service & Parts as a Buffer Revenue Stream

When front-end volume is unpredictable, fixed operations become the dealership’s most dependable source of revenue. Service and parts departments can mitigate the impact of inventory shortages by enhancing customer retention, improving operational efficiency, and expanding value-added services.

Ways to Strengthen Service & Parts Performance:

- Customer Retention Focus: Re-engage recent buyers through maintenance plans, loyalty discounts, and service reminders to encourage them to return regularly.

- Service-to-Sales Coordination: Share service data with the sales department to identify customers whose vehicles are nearing the end of their lifecycle or approaching the ideal trade-in window.

- Upsell Training: Train advisors to present additional services, protection products, and accessories in a consultative, customer-first way.

- Efficiency Audits: Regularly assess technician productivity, parts availability, and scheduling accuracy to reduce bottlenecks and increase billable hours.

- Inventory Integration: Keep your DMS and parts management systems aligned to prevent overstocking low-demand items and underordering fast-moving items.

Review repair order data monthly to identify trends, such as repeat issues, frequent part shortages, or declining labor sales, and develop short-term action plans with your fixed operations team. Minor process improvements, when measured consistently, can add up to significant revenue gains.

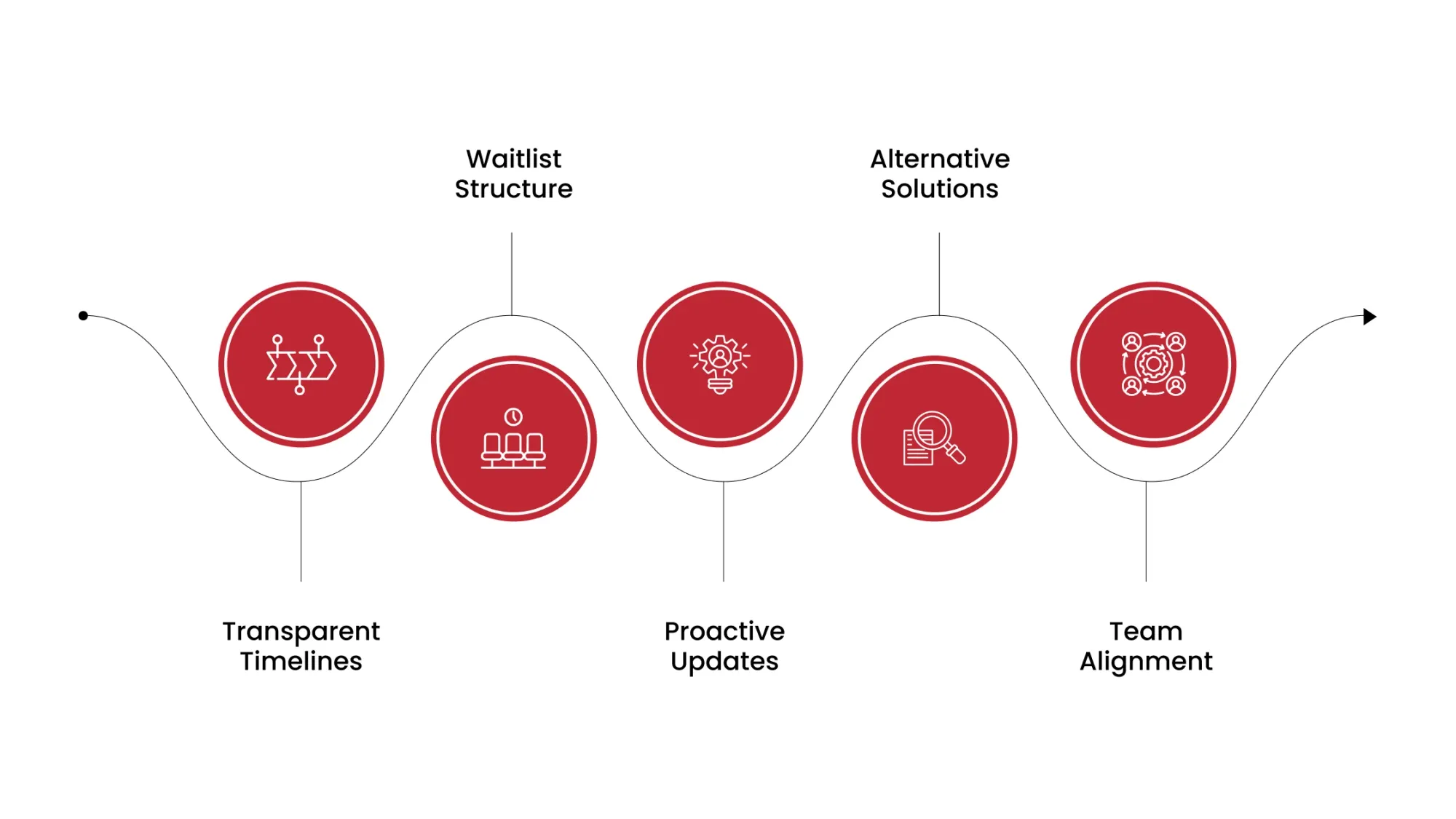

4. Enhance Customer Communication & Waitlist Management

During inventory shortages, transparency and communication can make or break customer relationships. Buyers will wait for the right vehicle if they trust your process, but they won’t stay if they feel ignored. Managing expectations clearly and consistently builds credibility, prevents frustration, and keeps potential deals alive even when delivery times are uncertain.

Best Practices for Customer Communication:

- Transparent Timelines: Provide honest estimates on vehicle availability and keep customers updated on status changes, even if the update is “no change yet.”

- Waitlist Structure: Use your CRM to create organized waitlists by model, trim, and color preference. Set automated reminders for regular check-ins.

- Proactive Updates: Send quick videos or email messages showing incoming units, model updates, or alternative options that match the customer’s needs.

- Alternative Solutions: Offer short-term lease extensions, demo vehicles, or pre-owned options to customers who don’t want to wait months for delivery.

- Team Alignment: Train sales, BDC, and management teams to deliver consistent messaging so customers receive the same information across all touchpoints.

Add “waitlist follow-ups” to your weekly CRM review. Have each salesperson share one example of how they communicated with waiting customers. This reinforces accountability and gives your team new ideas for keeping clients engaged.

5. Utilize Smart Pricing & Promotional Strategies

When inventory is limited, pricing becomes one of the most effective levers a dealership can pull. The goal is to maintain profitability while protecting long-term customer trust. Smart pricing strategies strike a balance by utilizing data, demand, and timing to inform every decision.

Major Approaches to Smarter Pricing and Promotions:

- Data-Driven Adjustments: Use DMS and market analysis programs to review pricing weekly. Adjust based on days-to-turn, customer demand, and local competition rather than relying on flat markups.

- Bundled Value Offers: Instead of cutting front-end prices, create bundled promotions that include service plans, protection products, or accessories. This keeps gross strong while increasing perceived value.

- Inventory Aging Alerts: Set automated notifications for vehicles that have been in stock for 45 or 60 days or more. These units should trigger immediate promotional activity or consideration for trade-in.

- Dynamic Used-Vehicle Pricing: Review used-car prices daily against live market trends to avoid overstocking and maintain competitiveness.

- Finance Collaboration: Coordinate with your F&I team to offer flexible finance options or loyalty incentives that make buying now more appealing than waiting.

Hold a short “pricing pulse” meeting every Friday. Review high-demand units, identify slow-moving items, and determine which vehicles will receive weekend promotions or priority digital advertising. This keeps your pricing responsive, not reactive.

Major Metrics & Monitoring Framework

Every effective inventory strategy relies on visibility. Tracking the right metrics keeps leadership informed, aligns departments, and prevents problems from being obscured by averages. Regular performance reviews transform data into informed decisions, enabling your team to adapt before challenges impact profitability.

Below is a simple framework dealerships can use to monitor performance across sales, inventory, and operations:

How to Apply the Framework:

Assign clear ownership to each metric. For example, sales managers monitor turn rates and lead conversions, while accounting oversees floor plan costs. Review results consistently in department meetings and identify one improvement action for each underperforming category.

When these numbers become part of your dealership’s regular rhythm, performance stops being reactive. Leadership gains control, employees understand their impact, and the dealership operates with precision, even in unpredictable market conditions.

Build Consistency Despite Inventory Challenges with ATN

Inventory shortages, shifting customer expectations, and margin pressures all demand a dealership that performs with structure and consistency. ATN helps you build exactly that.

With over 40 years of experience and serving more than 12,000 dealerships, Automotive Training Network (ATN) provides the people, systems, and coaching your team needs to perform at its best, regardless of the market.

Here’s how ATN helps your dealership grow:

- In-Dealership Training: Hands-on workshops that improve sales, service, and management performance through real-world application.

- Virtual and Bootcamp Programs: Interactive courses for BDC, F&I, and leadership teams focused on communication, process, and accountability.

- Consulting and Analysis: Expert reviews of your operations, profitability, and processes to identify hidden growth opportunities.

- Full Dealership Management: Dedicated specialists overseeing every department, from sales and fixed ops to accounting and digital marketing, ensuring alignment and results.

ATN is a partnership built around measurable improvement. Our programs give your team the resources, confidence, and accountability to lead in every market condition.

See what structured training, expert management, and proven systems can do for your business.