Which Federal Laws Do Car Dealerships Need to Know About?

Car dealerships in the United States face the unique challenge of balancing customer satisfaction with strict legal compliance. With over 15 million new cars and trucks sold annually across the country, dealerships operate in one of the most regulated industries in the economy. What’s at stake? Non-compliance can lead to penalties, lawsuits, or even the loss of a business license.

Federal laws govern nearly every aspect of dealership operations, from financing and advertising to customer data protection and environmental compliance. Adhering to these regulations is a legal obligation that builds trust and fosters long-term customer relationships.

In this blog, we will discuss the critical federal laws every car dealership should know, helping you confidently navigate the rules and ensure a smooth, compliant operation.

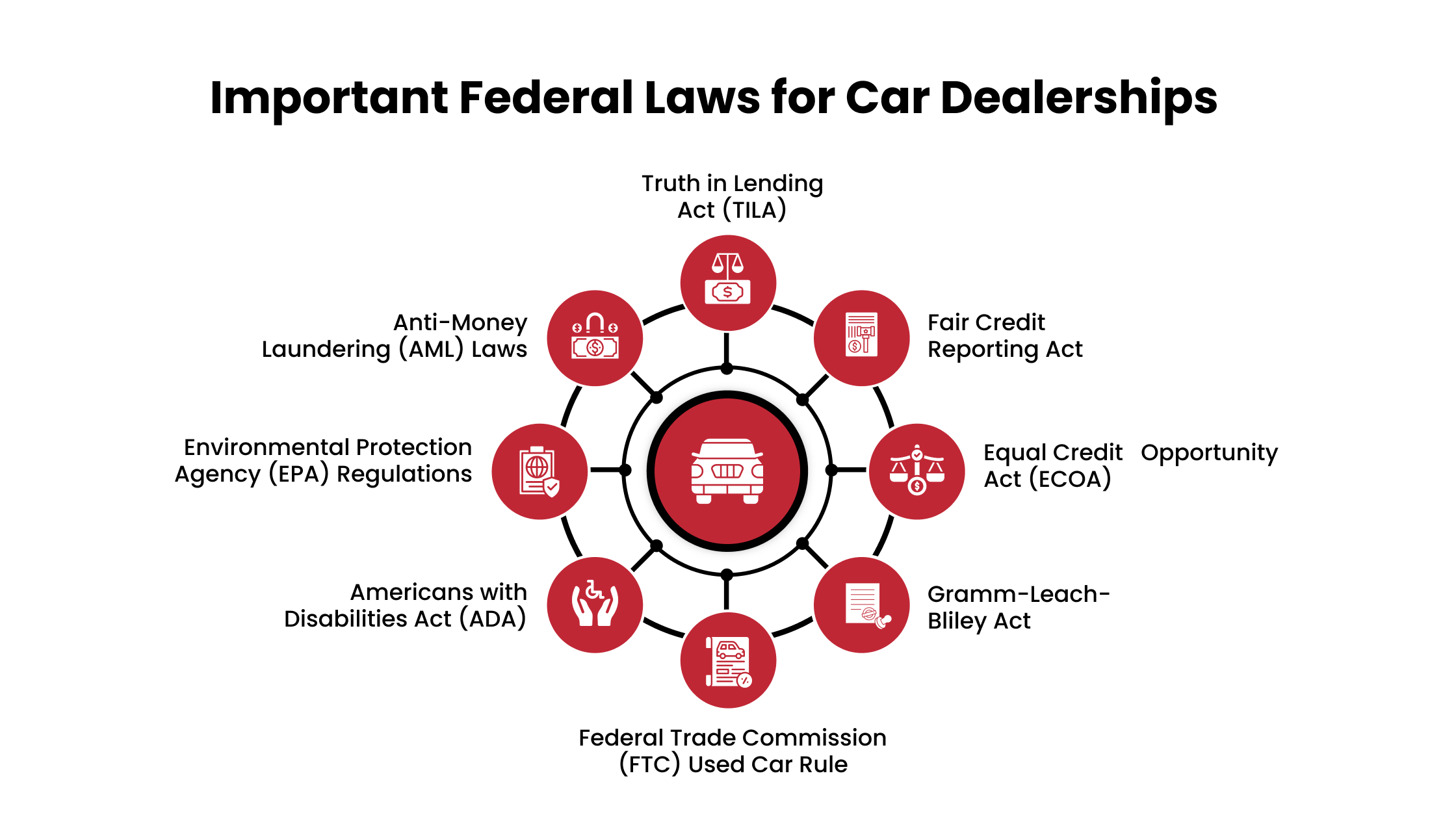

Important Federal Laws for Car Dealerships

Understanding all federal laws can feel overwhelming, especially with so many rules to follow. However, understanding these regulations isn’t just about avoiding penalties. It’s about creating a transparent and trustworthy experience for your customers.

Truth in Lending Act (TILA)

The Truth in Lending Act (TILA) is a vital consumer protection law that ensures customers fully understand the terms of their loans or credit agreements. For car dealerships, this means being upfront and transparent about financing details, enabling customers to make informed decisions without confusion or surprises.

What Does TILA Require?

Under TILA, dealerships must disclose all terms related to financing. This includes:

- Annual Percentage Rate (APR): The total cost of credit expressed as a yearly rate.

- Payment Schedule: The amount, number, and frequency of payments.

- Total Cost: The total amount the customer will pay over the life of the loan, including interest and fees.

Transparency in financing ensures legal compliance and builds trust with customers. When buyers see clearly outlined loan terms, they’re more likely to feel confident about their purchase. Conversely, non-compliance can lead to severe consequences, including fines, penalties, and lawsuits.

Best Practices for Dealerships

- Automotive sales training to communicate loan details clearly and accurately.

- Use standardized disclosure forms to avoid errors or omissions.

- Regularly review your financing processes to ensure they meet TILA requirements.

Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) is an essential regulation for car dealerships, particularly those offering financing options. This law ensures the ethical handling of consumer credit information, emphasizing accuracy, transparency, and privacy. Since credit reports are a cornerstone of vehicle financing, dealerships must comply with FCRA requirements to protect their customers and businesses.

Under the FCRA, dealerships must secure explicit consent from customers before accessing their credit reports. This step safeguards consumer privacy and ensures transparency in the financing process. Dealerships risk violating federal law without proper authorization, which could lead to fines and legal action.

Using Credit Information Responsibly

Once a credit report is accessed, it can only be used for legitimate purposes, such as evaluating loan applications or setting financing terms. Misusing credit data for any other reason is a violation of FCRA regulations. This strict framework ensures dealerships maintain a professional and lawful approach to credit evaluations.

Handling Adverse Actions

If a dealership denies financing based on information in a credit report, the FCRA mandates that the customer receive an adverse action notice. This notice must include the reason for the denial, the name and contact information of the credit reporting agency used, and instructions for disputing inaccuracies in the customer's credit report.

This process ensures transparency and allows customers to correct any errors in their financial records.

Ensuring Accuracy and Accountability

Dealerships must ensure the credit data they use is accurate and up-to-date. Relying on incorrect or outdated information can lead to unfair customer outcomes and potential legal repercussions for the dealership. Regular audits and staff training can help mitigate these risks and promote compliance. Discover how ATN’s training solutions can help your dealership comply with federal regulations and optimize operations."

Customers expect their financial information to be handled with care and respect. By following FCRA guidelines, dealerships demonstrate their commitment to fairness and privacy, which can foster long-term loyalty and repeat business.

Equal Credit Opportunity Act (ECOA)

The Equal Credit Opportunity Act (ECOA) is a critical federal law that ensures fairness and equality in lending practices. For car dealerships offering financing options, the ECOA mandates that all credit applicants be treated equitably, regardless of personal characteristics unrelated to their financial capacity.

What Is the Purpose of the ECOA?

The ECOA aims to eliminate discrimination in credit transactions, ensuring customers have equal access to financing opportunities. It prohibits dealerships—and all creditors—from making lending decisions based on the following:

- Race, color, or national origin.

- Religion or sex.

- Marital status or age (as long as the applicant is of legal age).

- Receipt of public assistance income.

Instead, decisions must solely rely on objective factors such as credit history, income, and debt-to-income ratio.

How ECOA Affects Dealership Financing

Car dealerships often evaluate creditworthiness or facilitate loans through third-party lenders. Under the ECOA, dealerships must ensure that all customers are treated fairly throughout this process. This includes offering equal terms, applying consistent evaluation criteria, and avoiding practices that could unintentionally exclude certain groups of people.

For example, if a dealership offers special financing terms to married couples, those same terms must also be made available to single individuals with comparable financial profiles.

Notice of Adverse Action

Like the Fair Credit Reporting Act (FCRA), the ECOA requires dealerships to notify customers if their credit application is denied or offered less favorable terms than requested. This notification, known as an adverse action notice, must include:

- The specific reasons for the adverse decision (or a statement that the customer can request these reasons).

- The name and contact information of the lender or dealership.

This transparency helps customers understand why a decision was made and ensures accountability in lending practices.

Non-compliance with the ECOA can lead to severe penalties, including fines, lawsuits, and reputational damage. Beyond legal risks, intentional or unintentional discriminatory practices can erode trust and alienate potential customers. Compliance demonstrates a dealership’s commitment to ethical and inclusive business practices, building credibility and fostering loyalty among diverse customer bases.

Gramm-Leach-Bliley Act

The Gramm-Leach-Bliley Act (GLBA) protects consumer privacy, especially for industries handling sensitive financial information like car dealerships. Since dealerships often collect and store customer data during financing or leasing transactions, compliance with the GLBA is essential to avoid legal repercussions and maintain customer trust.

The GLBA requires businesses that offer financial products or services, including car dealerships, to safeguard customer information. This act enforces strict rules on collecting, using, and sharing personal data, prioritizing customers' privacy.

The GLBA has three primary components dealerships must comply with:

- Privacy Rule: This rule mandates informing customers how their data is collected, used, and shared. Dealerships must provide a clear privacy notice at the beginning of a customer relationship and annually thereafter, detailing their data-sharing practices.

- Safeguards Rule: Dealerships must implement strong security measures to protect customer information. This includes developing, maintaining, and regularly testing an information security program tailored to the dealership’s size and complexity.

- Pretexting Protection: This rule prohibits pretexting, where unauthorized individuals use deceit to access private customer information. Dealerships must train employees to identify and prevent such schemes.

How GLBA Affects Dealership Operations

During the financing process, car dealerships collect personal information, such as Social Security numbers, credit history, and employment details. Under the GLBA, dealerships must:

- Ensure that all collected information is securely stored and protected against unauthorized access.

- Limit the sharing of customer data to authorized third parties, such as lenders, unless the customer explicitly consents to broader sharing.

- Provide customers with opt-out options if they do not want their information shared beyond what is legally required.

Failure to comply with the GLBA can result in significant penalties, including fines and legal action. Beyond regulatory consequences, mishandling customer data can damage a dealership’s reputation, leading to lost business and reduced trust.

Federal Trade Commission (FTC) Used Car Rule

The Federal Trade Commission (FTC) Used Car Rule is another regulation that affects car dealerships, mainly those selling used vehicles. This rule aims to protect consumers from deceptive practices and ensure transparency in used car sales. It provides potential buyers with critical information about the vehicle condition they are purchasing.

The FTC Used Car Rule requires dealerships to display a "Buyers Guide" on every used car they offer for sale. This guide discloses important information about the vehicle, including its condition, warranties, and any known issues. The rule applies to any car dealership selling used cars, whether new or established, and to vehicles sold on and off the lot.

The Buyers Guide must include the following:

- Warranty Information: Dealerships must specify if the car is sold "as-is" or with a warranty. If a warranty is offered, the guide must include details about the type, duration, and coverage of the warranty.

- Major Mechanical Defects: If applicable, the guide must list any known defects or problems affecting the car’s performance.

- Vehicle Condition: The rule requires dealerships to disclose whether the vehicle has been inspected or reconditioned and any known major repairs.

- Price Information: While the rule does not mandate that the price be listed on the Buyers Guide, dealerships should make it easily accessible for customers.

How Does the FTC Used Car Rule Protect Consumers?

The FTC Used Car Rule ensures that consumers are given the necessary information to make informed purchasing decisions. The rule helps prevent deceptive advertising practices and misleading claims about its condition by requiring dealerships to disclose a vehicle's condition and any warranties.

The “As-Is” Disclosure is especially important for used car buyers. The dealer must indicate this on the Buyers Guide if a car is sold without warranty (i.e., “as-is”). This helps set proper customer expectations and prevents future disputes about the vehicle’s condition.

Car dealerships that do not comply with the FTC Used Car Rule can face serious legal and financial consequences. Violations can result in fines, legal action, and damage to the dealership’s reputation. The FTC can impose civil penalties for any deceptive or misleading practices related to the sale of used cars, including failing to provide proper disclosures or misrepresenting the vehicle's condition.

Americans with Disabilities Act (ADA)

The Americans with Disabilities Act (ADA) is a pivotal federal law that ensures people with disabilities have equal access to opportunities and services. For car dealerships, this means complying with guidelines that make facilities accessible to individuals with disabilities, both physically and in terms of communication.

What Does the ADA Require of Car Dealerships?

Under the ADA, car dealerships must provide an accessible environment to all customers, regardless of any physical impairments. This includes:

- Accessible Buildings: Dealerships must ensure that their physical locations, such as showrooms, restrooms, and parking lots, comply with ADA accessibility standards. This includes wheelchair ramps, wide doorways, accessible parking spaces, and restrooms designed for people with disabilities.

- Communication Access: Dealerships must provide reasonable accommodations for customers with hearing or vision impairments. This could include offering sign language interpreters, providing written materials in accessible formats, or utilizing assistive technology.

- Accessible Website: Car dealerships with an online presence should ensure their websites comply with the ADA by implementing web accessibility practices for individuals with visual or auditory impairments.

Failure to comply with the ADA can result in legal action, including lawsuits or fines and damage to a dealership's reputation. By adhering to the ADA, dealerships foster an inclusive environment that serves a broader customer base.

Environmental Protection Agency (EPA) Regulations

The Environmental Protection Agency (EPA) enforces various regulations that impact car dealerships, particularly regarding vehicle emissions and waste disposal. Dealerships must comply with federal environmental standards to avoid fines and contribute to sustainable practices.

Under the Clean Air Act, the EPA regulates vehicle emissions to control air pollution. Car dealerships that sell new or used vehicles must ensure that their cars meet EPA standards for emissions. Dealerships may also be involved in maintaining vehicle emissions systems, requiring them to stay up-to-date with regulations on repairs or modifications.

The EPA also enforces rules on how dealerships handle hazardous materials, including waste from vehicle maintenance, cleaning, or body repairs. Proper disposal of oil, fluids, batteries, tires, and other dangerous substances is necessary to avoid fines and environmental harm.

Non-compliance with EPA regulations can lead to hefty fines, legal liabilities, and environmental damage. In addition, failing to comply with emissions standards or improper waste disposal can harm a dealership’s reputation, especially as consumers and regulatory bodies become more focused on environmental sustainability.

Anti-Money Laundering (AML) Laws

Anti-Money Laundering (AML) laws are regulations that detect and prevent money laundering, the illegal practice of making large sums of money from illicit activities appear legitimate. Car dealerships that offer financing options are particularly susceptible to AML risks, as high-value transactions, such as the sale of luxury or used vehicles, can be used to launder money.

What Do AML Laws Require of Car Dealerships?

Car dealerships must have certain AML practices to detect and report suspicious activity. These practices include:

- Customer Identification Program (CIP): Dealerships must collect certain identifying information from customers, such as names, addresses, and social security numbers, to verify their identity before completing the sale.

- Suspicious Activity Reports (SARs): If a dealership identifies potentially suspicious transactions (such as unusually large cash payments), it is required to file an SAR with the Financial Crimes Enforcement Network (FinCEN).

- Employee Training: Dealerships must train employees to recognize signs of suspicious activity, such as clients who offer huge amounts of cash or attempt to structure transactions to avoid reporting requirements.

Non-compliance with AML regulations can expose a dealership to significant penalties, including fines and potential criminal charges. Money laundering can tarnish a dealership's reputation, potentially alienating customers and investors.

Drive Excellence in Your Dealership with ATN's Training Solutions

With over 40 years of industry expertise, Automotive Training Network (ATN) offers a comprehensive suite of training solutions tailored to your dealership’s unique needs:

With ATN’s specialized training, your team can:

- Stay up-to-date with the latest federal regulations, minimizing legal risks.

- Ensure a seamless, compliant process for customers, from financing to vehicle sales.

- Provide transparent and effective communication, building trust with customers.

- Optimize operational efficiency while maintaining full regulatory compliance.

Contact us today to ensure your dealership’s success and compliance in an ever-changing legal industry!