How Can Your Dealership Conquer Automotive Compliance Challenges?

Running a dealership today means juggling sales goals, customer expectations, and a maze of regulatory requirements. Compliance is one of the most pressing concerns for automotive dealerships today. The mix of federal, state, and local regulations, encompassing everything from advertising disclosures and consumer data privacy to F&I practices, creates a complex web that dealers must navigate daily.

The concern is genuine. For the 9th consecutive year, auto-related complaints were the most frequently reported by consumers, involving issues such as deceptive advertising, lemon vehicles, and incomplete or faulty repairs.

That trend signals the constant spotlight regulators place on dealerships. Every sales pitch, F&I disclosure, and repair order is an opportunity to either build trust or trigger scrutiny. For dealership leaders, this creates a pressing question: how can you ensure that your team understands compliance obligations and integrates them seamlessly into everyday operations?

In this blog, we’ll discuss the most significant automotive dealership compliance challenges and provide practical strategies to help you overcome them with confidence.

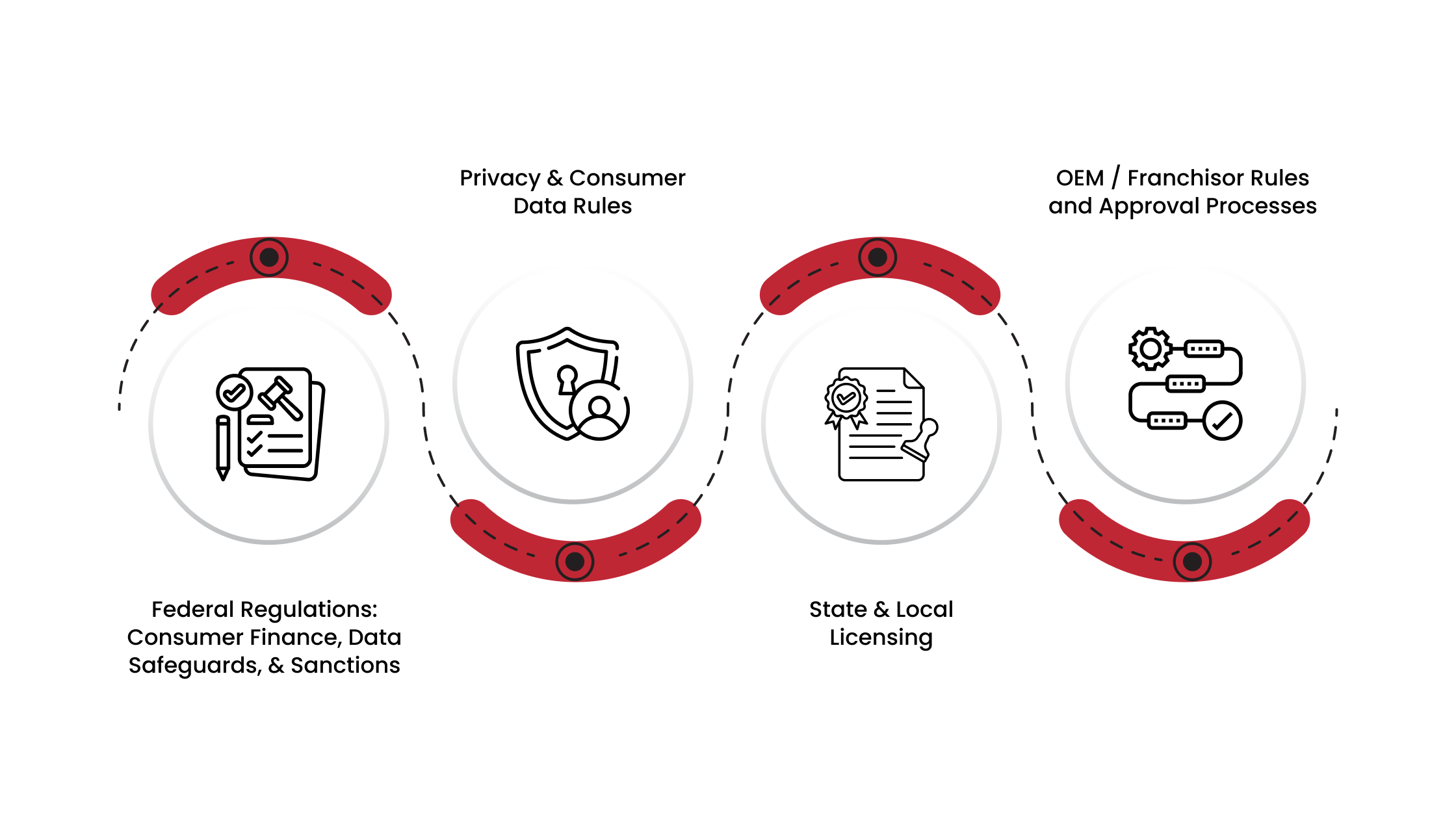

The Scope of Compliance Requirements

Dealership compliance now spans federal rules, state and local obligations, and manufacturer (OEM) franchise requirements. Each layer imposes different duties and timelines. Failing to follow any one of them can result in financial penalties, contract risk, or operational delays.

Federal Regulations: Consumer Finance, Data Safeguards, & Sanctions

Automotive dealership compliance at the federal level is multifaceted and constantly evolving. Dealers are expected to maintain transparent financing practices, protect consumer data, and conduct proper sanctions screening. Failing to meet any of these standards can result in severe penalties, lawsuits, or a loss of customer trust. Below are the main regulatory areas that demand close attention in 2025:

- Truth in Lending (Reg Z): Requires clear disclosure of credit terms and updated annual thresholds for finance transactions.

- Fair Credit Reporting Act & Equal Credit Opportunity Act: Regulates the use of credit data and ensures non-discriminatory lending practices.

- GLBA Safeguards Rule: Mandates written security programs, vendor oversight, and data protection measures.

- OFAC Sanctions Compliance: Requires screening of all customers and payments against updated federal sanctions lists.

Privacy & Consumer Data Rules

Data privacy is a crucial aspect of automotive dealership compliance, as customers share sensitive financial, personal, and digital information during the buying process. Dealers must navigate overlapping privacy laws that extend beyond California and affect how data is collected, stored, and shared.

The Gramm-Leach-Bliley Act (GLBA) requires safeguards for consumer financial data, while the FTC’s Safeguards Rule now enforces stricter security protocols and vendor accountability. States such as Virginia, Colorado, and Connecticut have enacted privacy laws modeled after the European Union’s GDPR, thereby broadening compliance requirements nationwide.

Dealers must also post clear privacy notices, allow customers to opt out of data sharing, and implement breach response protocols. Staying proactive not only avoids penalties but also strengthens customer confidence in the dealership.

State & Local Licensing

Title, registration, and dealer licensing rules vary by state and are evolving to require more electronic processing and audit trails. Several states issued 2024–2025 mandates that changed how dealers submit titles, disclosures, and registration paperwork.

Some states now require specific online portal usage for transactions and renewals. Confirm your state’s motor-vehicle office updates and timelines, and adopt the e-filing tools where mandated.

OEM / Franchisor Rules and Approval Processes

Automotive dealership compliance is not limited to government mandates. OEMs and franchisors also impose strict operational and branding requirements. These rules protect the manufacturer’s reputation and ensure consistency across dealer networks.

Non-compliance can result in penalties, loss of incentives, or even termination of agreements. Dealers must often navigate approval processes before implementing business changes, making marketing adjustments, or upgrading facilities. Some common areas include:

- Branding and Facility Standards: Showroom layouts, signage, and customer experience protocols.

- Sales and Incentive Programs: Adherence to OEM rebate structures and promotional campaigns.

- Warranty and Recall Handling: Timely processing of claims and accurate reporting.

- Advertising and Marketing Approvals: Ensuring campaigns align with OEM brand guidelines.

- Operational Reviews: Regular audits and performance evaluations by manufacturer representatives.

Substantial compliance with OEM expectations helps dealerships maintain access to incentives, support programs, and a competitive standing within their market.

Common Compliance Challenges Dealerships Face

Even dealerships with robust processes in place often struggle with staying compliant across multiple areas. New regulations emerge, OEM rules change, and state-level requirements vary widely. These pressures create gaps that can expose dealerships to financial, legal, and reputational risks. Some of the most common challenges include:

- Advertising Accuracy: Misleading offers, unclear disclaimers, or non-compliant promotions.

- Finance & Insurance Practices: Incomplete disclosures, discriminatory lending, or mishandled credit checks.

- Data Security: Weak safeguards that put customer information at risk of breaches.

- Recordkeeping & Documentation: Missing, outdated, or improperly stored sales and service files.

- Training Gaps: Staff are often unaware of their compliance responsibilities or exhibit inconsistent adherence to policies.

- Environmental & Emission Standards: Failure to meet local or federal requirements for vehicle testing and reporting.

These challenges often arise not from intent but from complexity. When compliance is treated as an afterthought, dealerships risk incurring regulatory fines, eroding customer trust, and incurring costly legal disputes. Making compliance a proactive part of daily operations helps protect both profitability and reputation.

Methods & Practices to Ensure Compliance

Staying ahead of automotive dealership compliance requires structured tools and disciplined practices. Regulations impact every corner of dealership operations, meaning manual oversight alone is often insufficient.

By adopting compliance-focused systems and embedding consistent routines into daily workflows, dealerships can reduce risks while building a culture of accountability. These resources and practices streamline reporting and monitoring, empowering staff to confidently handle regulatory obligations and minimize the risk of errors or oversights.

Digital Recordkeeping & Document Management Systems

Paper trails are no longer enough to meet the demands of automotive dealership compliance. A robust digital document management system centralizes all essential files, including financing agreements, repair orders, customer disclosures, and sales contracts.

These platforms enable documents to be easily searchable, securely stored, and accessible to authorized staff as needed. Many also include audit trails and automated alerts for expirations, helping dealerships stay ahead of renewals and deadlines.

Beyond convenience, digital recordkeeping minimizes the risk of misplaced paperwork, unauthorized access, and incomplete files, all of which can lead to costly compliance violations. With the right system in place, dealerships gain both peace of mind and operational efficiency.

Integrated Dealership Management Systems That Sync with Compliance Tools

Modern compliance demands coordination across sales, service, finance, and recordkeeping. An integrated Dealer Management System (DMS) connects various dealership functions, from F&I disclosures to warranty reporting, in a single, centralized, and controlled platform.

When compliance tools such as digital signatures, audit logs, credit reporting, and secure customer data modules are built into the DMS, dealerships reduce manual risk, ensure accuracy, and maintain better oversight.

A compliance-ready DMS typically includes:

- Automated credit checks and disclosures to meet lending regulations.

- Secure storage and encryption for customer data.

- Audit trails that document employee actions for accountability and transparency.

- Real-time reporting tools that flag compliance gaps early.

Automotive Training Network’s Dealership Management Program supports this integration. Dealerships receive guidance on configuring their DMS to enforce compliance best practices. The program includes the setup of compliant workflows, training for staff on using embedded compliance tools, and ongoing audits to ensure that all parts of the DMS are used correctly.

Regular Audits, Spot Checks, & Dealer Self-Auditing

Compliance is never a “set it and forget it” process. Regulations evolve, customer expectations shift, and dealership operations change over time. Regular audits help identify blind spots before they turn into costly violations. Internal reviews keep teams accountable, while external audits bring in objective insights that uncover issues staff might overlook.

Effective dealership compliance auditing often involves:

- Internal Audits: Routine checks on paperwork, disclosures, and data handling.

- External Audits: Third-party reviews that validate compliance processes against federal and state standards.

- Spot Checks: Randomized reviews of deals, service invoices, and F&I practices to ensure consistency.

- Self-Auditing Tools: Templates and digital checklists that help managers proactively monitor risk areas.

Dealerships that build a culture of ongoing auditing minimize surprises during official inspections. This habit not only prevents fines but also strengthens trust with customers and regulators by demonstrating a proactive commitment to compliance.

Clear Policies and Standard Operating Procedures (SOPs)

Strong compliance begins with clarity. Dealerships that lack well-documented policies often leave room for interpretation, leading to inconsistent practices and unnecessary risks. Establishing clear, written policies for sales, financing, service, and data handling ensures every employee understands expectations and responsibilities. These policies should be practical, easily accessible, and regularly updated as regulations evolve.

Standard Operating Procedures (SOPs) transform those policies into daily actions. For example, SOPs can define precisely how staff disclose financing terms, collect signatures, or store customer records. By providing step-by-step guidance, dealerships reduce the likelihood of mistakes and make training more effective.

Role of Training and Staff Accountability

Compliance programs succeed only when employees understand both the rules and their role in upholding them. Regular training ensures that staff can apply regulations in real-world scenarios, rather than relying on guesswork. Without this, even the best policies and systems lose their effectiveness.

Automotive Training Network (ATN) helps dealerships strengthen this foundation by offering role-specific training across:

- Sales – Teaches ethical sales practices, proper disclosure, and how to avoid misrepresentation in deals.

- BDC – Equips teams to handle customer inquiries with compliant communication standards and avoid deceptive advertising issues.

- Finance – Guides Truth in Lending (Reg Z), Fair Credit Reporting, Equal Credit Opportunity Act, and other F&I compliance essentials.

- Fixed Operations – Ensures service and parts staff follow environmental, warranty, and repair order regulations to avoid liability.

- Executive Management – Helps leaders set compliance-driven policies, monitor risks, and ensure alignment with OEM and franchisor requirements.

- Accounting – Covers financial reporting accuracy, safeguards against fraud, and compliance with tax and recordkeeping obligations.

This comprehensive approach equips every department with the knowledge and skills necessary to maintain compliance while also prioritizing customer experience and profitability. When paired with strong accountability measures, such as performance monitoring, audits, and clear reporting lines, dealerships can reduce risk, improve consistency, and foster a culture of responsibility.

Partner with ATN to Strengthen Your Dealership Compliance

Automotive dealership compliance protects your reputation, avoids penalties, and builds lasting trust with customers. Complex regulations, shifting state laws, and stringent OEM requirements make it challenging to remain fully compliant without expert guidance.

ATN brings decades of dealership expertise and proven training programs designed to keep every department aligned with compliance standards while maintaining a focus on performance and profitability. With us, your team gains:

- Role-specific compliance training

- Integrated dealership management strategies to streamline recordkeeping and reporting

- Ongoing audits, performance reviews, and process refinement to stay ahead of risks

- Hands-on support to implement practical, compliance-driven policies

Your dealership doesn’t need to face compliance challenges alone. Learn how our training and management solutions can help you navigate regulations, protect your business, and keep your team accountable.